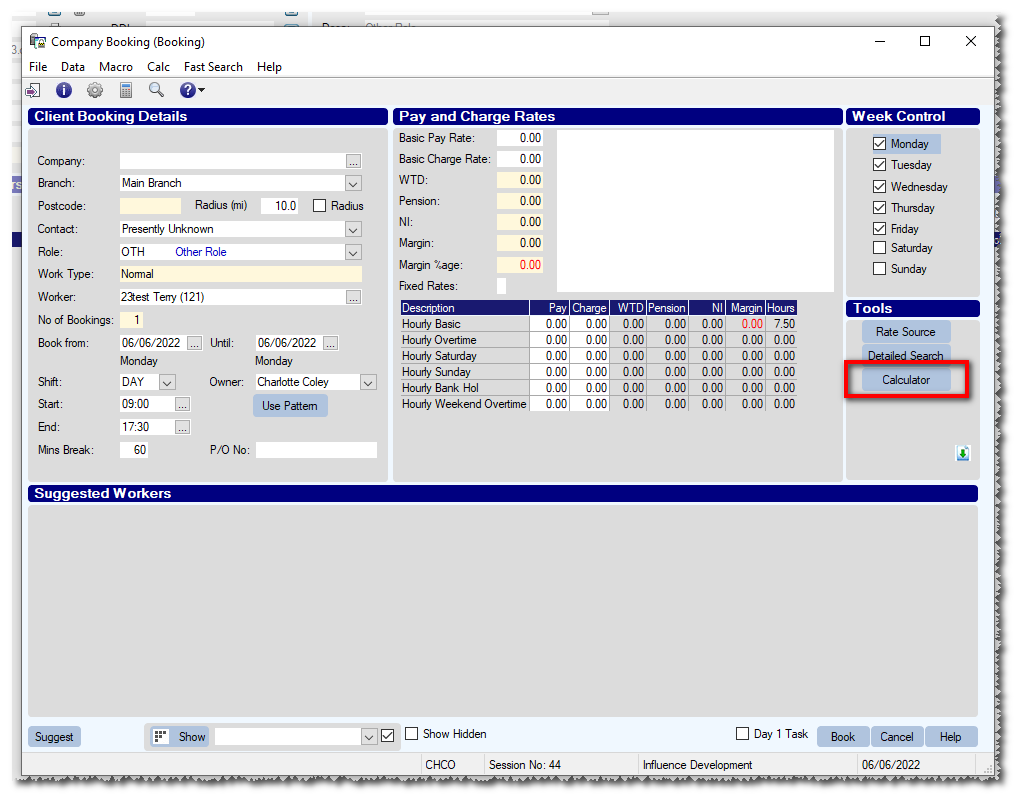

The Rate Calculator can be accessed from the toolbar at the top of most areas of the system and also from within the Placement screen when placing a contractor.

The rates calculator is a flexible tool that can be used to calculate multiple values.

Many of the figures at the top of the screen are used in making the calculations and the initial values are defaulted from parameters held within your Influence system.

| Annual working Days: |

Used to indicate the number of working days. |

| Paid Holiday Days: |

The number of paid holidays days per year. |

| Bank Holiday Days: |

The number of (UK) bank holidays per year. |

| Hrs/Day: |

Number of hours worked per day. (usually 8) |

| Days/Wk: |

Number of working days/week. (usually 5) |

| NI%: |

National Insurance contribution %age . |

| Pension%: |

Pension contribution %age. |

| NOTE: The default values for the above fields can be stored in the system parameters and can easily be changed if values such as the NI contribution changes in future. They are stored in the CALCULATOR parameter set. |

How it Works

The system can be used to estimate the Pay rate, charge rate or Margin, given the other two items.

(Versions after 1.00.17.019 allow you to specify a different pay rate for the calculation of holiday pay)

Example 1: If you wanted calculate the charge rate, then select ¤ charge.

Enter the Pay rate and the Margin% you wish to make, and the system will calculate what you need to charge.

Example 2: To calculate the pay rate given a fixed Charge & Margin %, select ¤ Pay.

Enter the Charge rate you have agreed and the Margin% you wish to make, and the system will calculate what can Pay the candidate.

When making these calculations the system will take into account any of the options you have ticked,

e.g

[ ]Include employers NI : This will take into account any NI contributions when calculating Pay, Charge or Margin.

[ ]Include Pension Contribution : Will take into account any Pension contributions when calculating Pay, Charge or Margin.

Margin% vs Markup%

The system can be used to calculate values in two ways;

Margin% : This calculates as (1 – (Cost of Sale/Charge)) x 100 %

Where Cost of Sale is the Total cost, including Pay Rate, NI, Holiday pay, etc.

Markup% : When used with this selected the system will calculate

( (Charge – Cost of Sale) / Charge ) x 100 (%)

Holiday Pay Rate: Sometimes in the case of workers being employed via an umbrella company it is possible that their hourly pay is different than the pay rate which they accumulate for holiday pay. If this is the case then enter the hourly rate for their holiday pay, otherwise it is assumed to be the same as the pay rate.

Martin Parkinson

Comments